Economic profit is quite different from either the total costs or the total financial revenue. However, all of these take into account implicit costs. Therefore, economic profit considers the opportunity costs which make it cheaper than the value that accounting profit provides. Production decisions take up the alternatives these opportunity costs provide. Moreover, accounting profit cannot work for a term as long as economic profit can. This is because the economic approach considers the long-term process and decides whether a firm should enter or exit from a certain market.

Accounting profit, on the other hand, is the difference between the total financial revenue and the total costs of the company. GAAP, which are the accounting principles, calculate it. It is, hence, entirely explicit and is more like a bookkeeping process. So, credits and debits which appear on the balance sheet of a firm are similar to this calculation. The total revenue is what the firm obtains after it has sold its items in a particular market. It operates for a much shorter duration like a financial quarter or maybe a year at the most.

What are the accounting profit and economic profit formulas?

Economic profit is closely linked with accounting profit. The latter is the profit that one finds on the income statement of a company. So, it measures the total inflows against the outflows. Moreover, this profit is key to maintaining the financial transparency of the company.

On the other hand, economic profit does not appear on a company’s financial statements. As a result, regulators, investors of the company, and the various allied financial institutions cannot see it. It is more like an apprehensive analysis. When the question of analyzing levels of production or making business investments come, the management of the company generally refers to it. It can prove to be an alternative for cases where the profit foregoes itself.

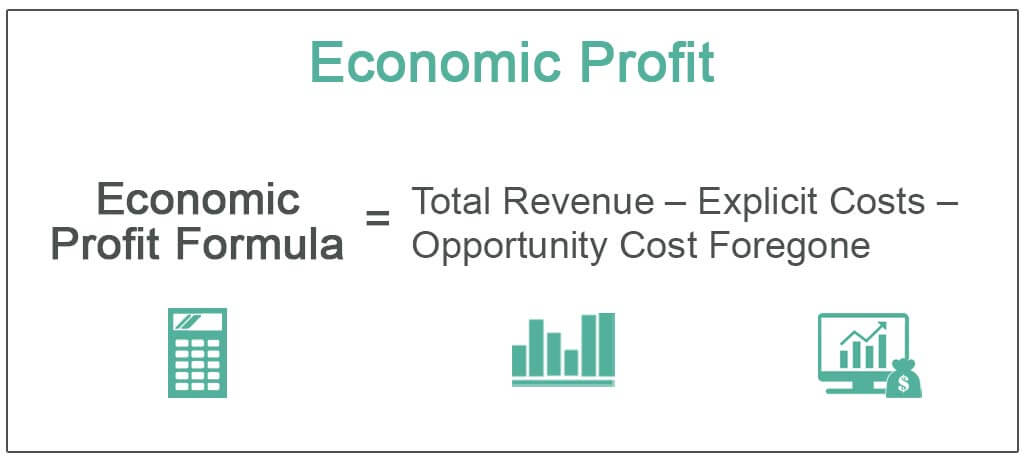

How to calculate economic profit?

The calculation of economic profit varies from scenario to scenario. However, the general equation is as follows-

Economic profit = revenues – explicit costs – opportunity costs

Now, in this equation, the entire expression holds true for accounting profit except the opportunity costs. However, the inclusion of opportunity costs is very important. It can indicate to the company several options that the organization can think about. This is an implicit cost. Hence, it does not appear on the income statement of the company.

The income statement of the company mentions only the explicit costs. The accounting profit appears at the last line of the income receipt. It shows the net value after there have been deductions of direct, indirect, and capital costs. While analyzing per-unit costs, the most primary explicit cost is that of the items which the company sells. So, in the given equation, the company can reduce the opportunity costs per unit at a scale of per-unit economic profit.

When the company calculates or manipulates the outcome on income due to an alternative decision, it might use economic profit. For beginners and entrepreneurs, the economic profit will show them the other substitutes that they can apply for the beginning year of business.

When the entities become bigger and scenarios become much more complex, the company owners and managers may check the net profit against the economic profit at various states of decision making.

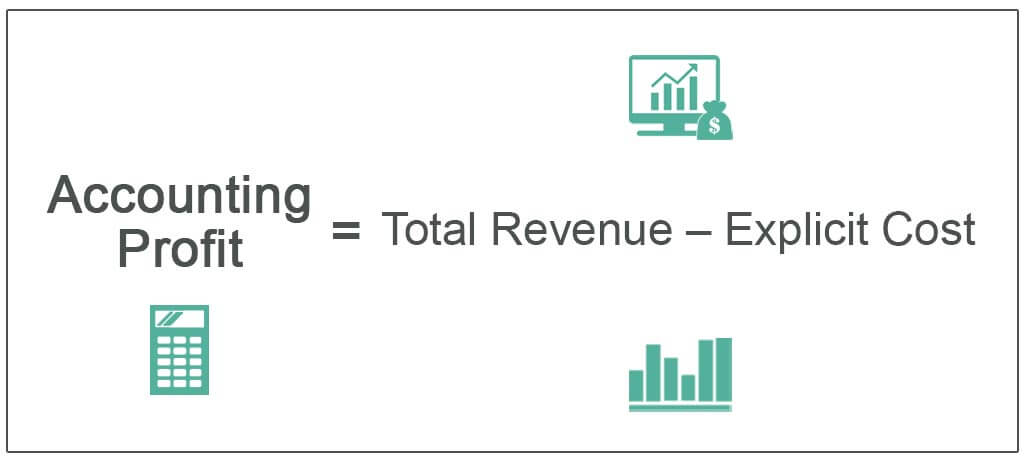

How to calculate accounting profit?

Now, as we already discussed, the expression to calculate accounting profit is very similar to the calculation of economic profit. However, the opportunity or implicit costs remain absent here.

So, the basic formula to find out profit is

Total Revenue- Explicit Costs.

Now, the detailed formula to find out profit is

Total revenue- the cost of items which the company has sold= Gross profit.

Now, the gross profit is the same as the accounting profit which is the sum of taxes and other operational expenses.

Therefore,

Accounting Profit = Total Revenue – (Cost of Goods Sold + Operating Expenses + Taxes)

So, now the question arises what are implicit and explicit costs. We shall discuss them in the next section.

What are implicit and explicit costs in economic profit and accounting profit?

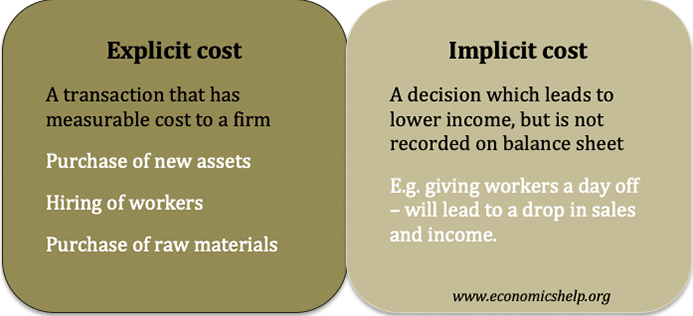

Explicit costs are the ones that matter directly in the money transactions of the company. For example, the wages that the company pays to its workers, the rent, the capital costs all fall under this category. As the name suggests, these costs are pretty explicit. The company cannot deny the transactions that they entail.

Read Also: Amensalism: Examples & Definition

On the other hand, implicit costs are the opportunity costs. These are already there with the producer. This refers to whatever the firm has to lose such that it can use its resources. Therefore, an implicit cost is a cost that arises because the firm chooses to use an asset rather than selling, lending, or renting it out.

Give examples of economic profit and accounting profit.

Economic profit example-

Suppose, a company needs $5 for making 1 shirt and earns $10 from selling it. So, the gross profit the company gets is $5. However, if they could use this revenue of $10 to provide shorts which would cost $2 per unit, they would gain an opportunity cost, This would amount to $8.

So, economic profit= $10- $5- $8 =$3.

Hence, if all the factors remain constant, the company had the chance to make $3 more for every unit had they decided to produce shorts and not shirts. So, this $3 is supposed to be an economic loss here.

Accounting profit example-

Let us say Ram owns Ray Brothers and Co. His company produces shirts. The annual revenue of his company is worth $2,000,000. The direct materials of production amount to a value of $2,00,000 in total. Labor costs are $50,000 and the overhead manufacturing costs are $1,00,000 in total.

The operational expenses are $2,00,000. Expenses on interest payment amount to $15,000. The depreciation cost of Ray Brothers and Co. property and factory, along with machinery include $10,000. Ram has to pay corporate taxes worth $25,000.

So, the total accounting profit is,

$2,000,000 – $350,000 – $200,000 – $15,000 – $10,000 – $25,000 = $1,400,000.

What is the difference between economic profit and accounting profit?

Economic profit |

Accounting profit |

| It is the total revenue of the firm minus the economic costs of the firm. Economic costs include both implicit and explicit costs. | It is the total revenue of the firm minus the explicit of the total accounting costs of the firm. |

| Economic profit = Revenue- explicit costs- implicit costs. | Accounting profit = Revenue- explicit costs. |

| This is the term that economists use and means the pure, total profit, | This is the term that accountants use to denote the business dealings of the firm. |

| It takes into account the profit that counts on resources coming both from outsiders as well as the owners. | This considers the profit that occurs only due to the resources that the outsiders provide. |

| It analyses how well the firm can allocate its resources for maximum utilization and profit. | This reflects on the profitability of the business transactions of the firm. |

| It takes into account a lot of assumptions. This makes it a little less practical. | It is entirely based on actual conditions. So, it is much more practical. |